Economic Slowdown Could Be Looming for the U.S. Economy

If you want to know where the U.S. economy is headed, look at how industrial stocks are performing. Sadly, they suggest that an economic slowdown could be looming for the United States.

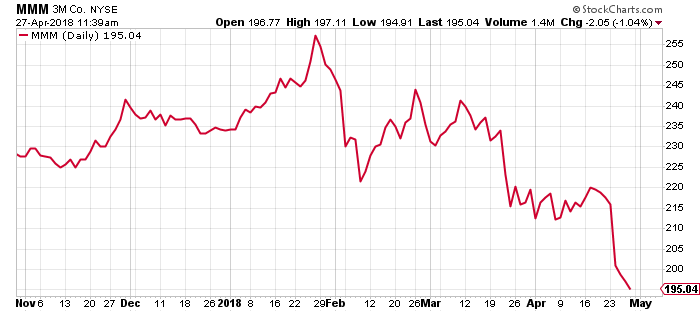

Consider 3M Co (NYSE:MMM), a diversified industrial company with major operations. It’s truly a bellwether stock for the U.S. economy. It increases in value when the country is witnessing growth and it declines when there’s an economic slowdown.

Prior to the recession of 2007–2009, 3M stock started to tumble, acting as a solid indicator for the U.S. economy.

Look at the chart below; 3M stock is crashing.

Chart courtesy of StockCharts.com

In January, 3M stock traded as high as $258.00. Now it trades at around $196.00. This represents a decline of over 24% in the matter of a few months.

Here’s the thing: it doesn’t look like the drop in 3M stock is about to end any time soon. So, it really raises the question whether the 3M stock price says that an economic slowdown could be nearing.

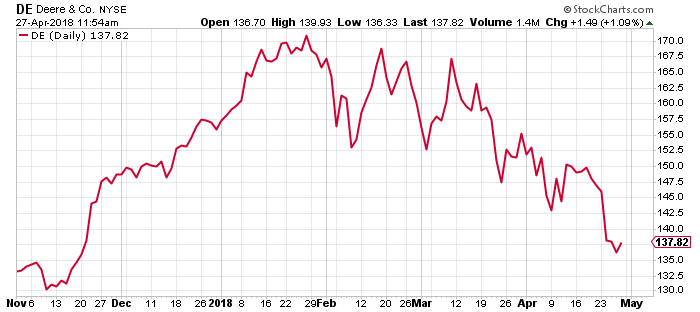

Another bellwether stock to watch is Deere & Company (NYSE:DE). Don’t think of this company as just a farming equipment manufacturer. It makes a lot of industrial equipment as well.

Look at the chart below of Deere & Company stock.

Chart courtesy of StockCharts.com

In January, DE stock traded as high as $171.00. Now it trades at around $136.00. This represents a decline of over 20% in few months.

Again, is this saying that an economic slowdown is on its way?

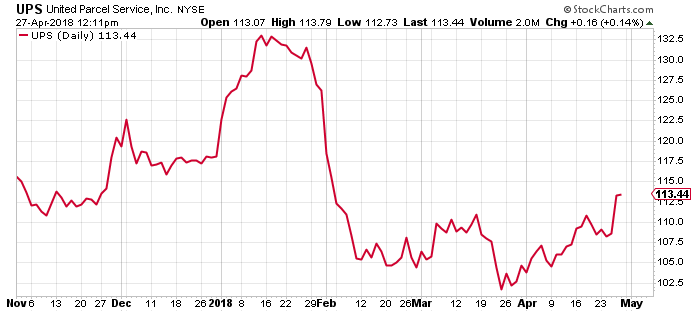

Look at United Parcel Service, Inc. (NYSE:UPS) as well. It’s another bellwether stock. A soaring UPS stock price suggests that the company’s financial situation could be getting better. In a booming economy, there’s usually a lot of business shipments.

If UPS stock tumbles, it means that business activity may be slowing down and that the overall U.S. economy could be headed toward an economic slowdown.

Chart courtesy of StockCharts.com

In January, UPS stock traded as high as $133.00. Now it trades at around $114.00. This represents a decline of more than 14%. In late March, it traded as low as $101.00, which was 24% below the January highs.

Don’t Ignore the Possible Economic Slowdown

Dear reader, it can’t be stressed enough: an economic slowdown could be looming for the U.S.

In these pages, I have harped over and over again about how the economic data could be taking a turn for the worse. The data is suggesting that the U.S. economy could be peaking now and that a recession could become reality.

If you are an investor and are taking all this lightly, you could be making a very big mistake.

Remember, stock market tops generally happen before the economy enters a period of economic slowdown. If a recession seems to be a likely scenario sooner rather than later, owning stocks could put a big dent in an investors’ portfolio.